CONSTRUCTION LOANS

CONSTRUCTION LOANS

Educate, Facilitate, Accelerate

At Loan Theory, we make the construction loan process simple, clear, and stress‑free. Whether you’re building your first home, creating your forever home, or taking on a custom build project, we guide you through every stage of the finance journey.

We work with over 30 lenders and have access to 200+ loan products, so we can match you with a construction loan that suits your budget, build timeline, and long‑term goals. Every lender has different rules around progress payments, valuations, and interest charges. We cut through the complexity so you can focus on building.

No matter what you’re building, we can help:

-

First‑Time Builders – Step‑by‑step support from pre‑approval to final payment

-

Knockdown & Rebuilds – Smooth finance from demolition to handover

-

Custom Builds – Tailored loan solutions for unique designs and specifications

-

Renovations & Extensions – Funding options for big or small upgrades

We work closely with you, your builder, and your lender to make sure progress payments are released on time and without hassle. We explain how interest is charged during construction, what to expect at each stage, and how to manage your budget effectively.

Our process is simple. We start by understanding your build plans and budget, then present loan options in plain language so you can choose with confidence. We handle the paperwork, liaise with the lender, and keep you updated from the first drawdown to the final payment.

And our relationship doesn’t end at handover. Once your build is complete, we’ll review your loan and help you transition to the most cost‑effective home loan for the future.

With Loan Theory, you’re not just getting construction finance — you’re getting a partner who’s with you from blueprint to move‑in day, and beyond.

COMMON CONSTRUCTION LOAN QUESTIONS

Here to answer all of your questions

What is your situation? What loan product is right for you? We have over 30 lenders, with over 200 different products. Not everyone is the same, not every loan is the same. Request a call today about your situation.

How is a construction loan different?

A construction loan is designed to fund the building of a home. Instead of receiving the full loan amount upfront like a regular home loan, the lender releases funds in stages (called progress payments) as your build progresses. During construction, you typically only pay interest on the amount that has been drawn down, not the entire loan. Once the home is finished, the loan usually converts to a standard principal and interest loan.

Do I need to own land before i can get a

construction loan?

Not necessarily. You can apply for a construction loan to cover both the land purchase and the build, or just the construction if you already own the land. The lender will assess both parts of the transaction together and offer a combined loan if needed.

How do progress payments work?

The lender pays your builder in instalments at key stages of the build (usually five or six stages: deposit, slab, frame, lock-up, fit-out, and completion). You’ll need to sign off on each stage before the lender releases funds. You only pay interest on the amount that’s been drawn so far, not the full loan.

Do I need a fixed-price contract?

Yes, most lenders require a fixed-price building contract from a licensed builder. This gives the lender (and you) confidence that costs won’t blow out and the loan will cover the full project. Cost-plus or variable contracts are usually not accepted.

Can I make changes to the build after loan

is approved?

It’s possible, but changes can be tricky once the loan is approved. If changes increase the cost, your loan may need to be reassessed and reapproved, which could delay things. It’s best to finalise your design and inclusions before applying for the loan.

What happens if the build goes over budget?

If your build costs more than expected, you’ll usually need to cover the shortfall from your own funds. Most lenders won’t increase the loan once it’s been approved unless you go through a new application process. Having a buffer in your savings is always a smart move.

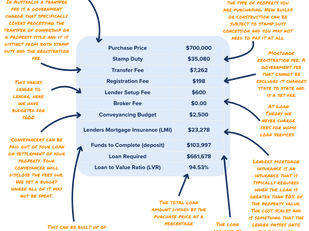

How much deposit do I need for a

construction loan?

This depends on the lender, but generally you’ll need at least 5–10% of the total project cost (land + build). If your deposit is under 20%, lenders mortgage insurance (LMI) may apply. If you already own the land, your equity in it can count as your deposit.

How are repayments calculated during

construction?

During the construction phase, you only pay interest on the amount drawn down — not the full loan. These are called interest-only repayments. Once the build is complete, your loan will switch to principal and interest repayments on the full balance.

Do I need council approval before applying for the loan?

Yes, most lenders will need to see council-approved plans and a signed building contract before they will fully approve your construction loan. You can get pre-approval based on estimates, but final approval usually requires all documents to be in place.

Can I use a construction loan for a renovation?

Yes, many lenders offer construction loans for major renovations or knockdown rebuilds. The key is that the renovation must be structural and require staged payments — cosmetic upgrades like painting or flooring won’t usually qualify for this type of finance.