FIRST HOME BUYER

FIRST HOME BUYER

Educate, Facilitate, Accelerate

At Loan Theory, we make buying your first home simple, clear and exciting. We know purchasing your first property can feel overwhelming, with so many steps, rules and loan options to navigate. Our job is to guide you through the process from start to finish so you can buy with confidence.

We work with over 30 lenders and have access to more than 200 loan products, so we can match you with a first home buyer loan that suits your budget, goals and lifestyle. Every lender has different rules for deposits, grants and borrowing capacity. We cut through the complexity so you know exactly what you can afford and what your next steps should be.

First home buyer loans can help you:

-

Understand your true borrowing power – Know what you can afford before you start house hunting

-

Access government grants and schemes – Maximise your eligibility for first home buyer support

-

Secure pre‑approval – Shop with confidence knowing your budget is confirmed

-

Structure your loan for the future – Choose features that work for you now and in years to come

We will guide you through everything from deposit requirements and government incentives to interest rates and loan features. We will also help you prepare for auctions or private treaty sales so you are ready to act when you find the right property.

Our process is straightforward. We start by understanding your goals, savings and income position. We then present clear loan options and explain the pros and cons of each. We manage the application process, keep you updated at every stage and make sure you are fully prepared for settlement.

Once you are in your new home, we will continue to review your loan regularly to ensure it remains competitive and suitable as your needs change.

With Loan Theory, you are not just getting your first home loan. You are getting a lending partner who will educate, support and guide you into home ownership with confidence.

FIRST HOME BUYER INCENTIVES

Educate, Facilitate, Accelerate

COMMON FIRST HOME BUYER QUESTIONS

Here to answer all of your questions

What is your situation? What loan product is right for you? We have over 30 lenders, with over 200 different products. Not everyone is the same, not every loan is the same. Request a call today about your situation.

How much can I borrow as a first home buyer?

Your borrowing power depends on your income, expenses, existing debts, deposit size, and the lender’s assessment criteria. We calculate this for you upfront so you know exactly what price range to look in.

How much deposit do I need?

Most lenders prefer a 20% deposit, but you can often buy with less. Some lenders accept as little as 5%, especially if you’re eligible for government schemes or have a guarantor. We can explore all your low‑deposit options.

Are there government grants or schemes I can access?

Yes. Depending on your state, you may be eligible for the First Home Owner Grant (FHOG), stamp duty concessions, or the First Home Guarantee. We’ll check your eligibility and help you apply so you don’t miss out.

What is Lenders Mortgage Insurance (LMI) and can I avoid it?

LMI is a one‑off cost charged when you borrow more than 80% of a property’s value. It protects the lender, not you. You can avoid it by saving a larger deposit, using a guarantor, or qualifying for a government scheme that removes the need for LMI.

Should I get pre‑approval before looking at properties?

Absolutely. Pre‑approval gives you a clear budget, makes you more confident at open inspections, and shows sellers you’re serious. It can also speed up the process when you make an offer.

What extra costs should I budget for when buying my first home?

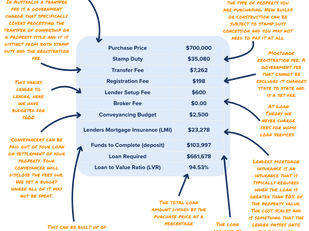

In addition to your deposit, budget for stamp duty (if applicable), legal and conveyancing fees, building and pest inspections, moving costs, and loan setup fees. We’ll provide you with a full cost breakdown before you start house‑hunting.

How does the home loan application process work?

We start by assessing your situation and finding the right lender and loan product for you. We then prepare and submit your application, handle lender questions, and guide you right through to settlement.

What types of home loans are available to me as a first home buyer?

You can choose from variable, fixed, or split‑rate loans, as well as loans with features like offset accounts or redraw facilities. We’ll help you choose the structure that works best for your budget and goals.

Can I buy with a friend or family member to get into the market sooner?

Yes, it’s possible. Many first home buyers pool resources to buy together. We’ll explain how joint ownership works, the legal agreements you should have in place, and the best loan structure for your situation.

How can a mortgage broker help me buy my first home?

We compare dozens of lenders to find the best loan for you, explain the process in plain language, guide you through every step, and make sure you’re taking advantage of all available grants and schemes. We’re here to make your first home purchase as smooth as possible.