RENOVATION LOANS

RENOVATION LOANS

Educate, Facilitate, Accelerate

At Loan Theory, we make financing your home renovations simple, clear and tailored to your goals. Whether you are upgrading a kitchen, adding an extension or transforming your entire home, we can help you access the right funding to bring your vision to life.

We work with over 40 lenders and have access to more than 200 loan products, so we can match you with a renovation loan that fits your budget, project scope and long term plans. Every lender has different rules around using equity, loan structures and progress payments. We make the process easy to understand and manage from start to finish.

Renovation loans can help with a variety of projects including:

-

Kitchen and bathroom upgrades – Modernise your most used spaces and increase your property value

-

Home extensions – Add more living space without moving

-

Major remodels – Completely transform your home to suit your lifestyle

-

Outdoor projects – Create functional and beautiful outdoor living areas

We will guide you through the different ways to finance your renovations, from using your existing home loan and accessing equity, to setting up a construction style loan for larger projects. We explain how interest is charged, what to expect at each stage and how to keep your budget on track.

Our process is simple. We begin by understanding your renovation goals and your financial position. We then present you with clear options so you can make confident decisions. We handle all the paperwork, communicate with your lender and keep you updated every step of the way.

Once your renovation is complete, we will review your loan to ensure you are on the most cost effective option for the future.

With Loan Theory, you are not just getting finance for your renovation. You are getting a partner who will support you from planning and approvals through to the finished project and beyond.

COMMON RENOVATION LOAN QUESTIONS

Here to answer all of your questions

What is your situation? What loan product is right for you? We have over 30 lenders, with over 200 different products. Not everyone is the same, not every loan is the same. Request a call today about your situation.

What is a renovation loan and how does it work?

A renovation loan is finance that allows you to fund improvements to your property, such as updating a kitchen, adding a new bathroom or extending your living space. You can use equity in your home, a personal loan or a loan specifically designed for renovations. The lender will assess your current loan, property value and renovation plans before approving the funds.

Can I use my existing home loan to fund renovations, or do I need a separate loan?

In many cases, you can top up your existing home loan rather than taking out a separate loan. This is usually done by increasing your current mortgage limit and using the extra funds for renovations. We can help you compare whether topping up your mortgage, refinancing, or taking out a dedicated renovation loan is the most cost‑effective option.

Do I need equity in my home to qualify for a renovation loan?

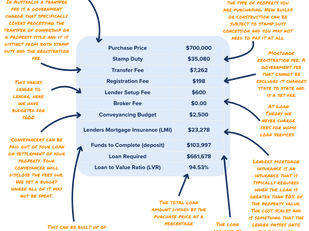

Yes, if you are using your home loan to fund renovations, you generally need equity — the difference between your home’s value and what you owe on it. Lenders typically require you to keep your loan within certain Loan to Value Ratio (LVR) limits, often 80% without Lenders Mortgage Insurance.

What types of renovations can a renovation loan cover?

Renovation loans can cover a wide range of improvements, from cosmetic updates like painting and flooring to major structural changes like extensions or second‑storey additions. You can also use them for landscaping, pool installation or adding energy‑efficient upgrades such as solar panels.

Can I use a renovation loan for DIY projects, or do I need licensed builders?

It depends on the lender and the scale of the work. Smaller cosmetic upgrades can sometimes be done as DIY, but for major renovations, lenders usually require quotes and invoices from licensed builders or tradespeople to ensure the funds are used appropriately.

How much can I borrow for renovations?

This depends on your income, expenses, existing loan balance and the equity in your home. Some lenders also take into account the expected value of your property after the renovations are completed, which may increase your borrowing capacity.

Do I need council approval or permits before applying for a renovation loan?

For most structural renovations or extensions, yes. Council approvals or building permits are often required, and lenders may ask to see these before releasing funds. For smaller, non‑structural updates, approvals are generally not needed.

What is the difference between a renovation loan and a construction loan?

Renovation loans are typically for improving or upgrading an existing property, while construction loans are for building a brand‑new home or completing major structural work from the ground up. Construction loans often release funds in stages, while renovation loans may provide a lump sum or staged payments depending on the lender.

How will the lender release the renovation loan funds?

Some lenders provide the renovation funds as a lump sum when your loan settles, while others release the money in stages as the work progresses. The method can depend on the size of the project, the lender’s policies and whether you are using licensed builders.

Will a renovation loan increase the value of my home?

Well‑planned renovations can increase your property’s market value, especially if they improve functionality, modernise the home or add extra living space. However, the return on investment depends on the type and quality of the renovations, local market conditions and buyer demand in your area.