DEBT CONSOLIDATION LOANS

DEBT CONSOLIDATION LOANS

Educate, Facilitate, Accelerate

At Loan Theory, we make debt consolidation through your home loan simple, clear, and achievable. If you’re juggling multiple debts such as credit cards, personal loans, or car finance. We can help combine them into your mortgage so you have one repayment, one interest rate, and a clear path forward.

We work with over 30 lenders and have access to 200+ loan products, so we can match you with a debt consolidation home loan that fits your budget and long‑term goals. Every lender has different rules around refinancing and consolidating debt. We cut through the complexity and make the process straightforward.

Common debts you can consolidate into your home loan include:

-

Credit Cards – Clear high‑interest balances faster

-

Personal Loans – Reduce repayments by spreading them over your mortgage term

-

Car Loans – Lower your interest rate and simplify repayments

-

Buy Now, Pay Later – Remove multiple short‑term debts from your budget

We’ll review your current home loan and debts, calculate your potential savings, and guide you through the refinance process from start to finish. Our goal is to help you reduce your interest costs, simplify your finances, and free up cash flow for what really matters.

Our process is simple. We start by understanding your financial situation and goals, then present options in plain language so you can choose with confidence. We liaise with your lender, handle the paperwork, and keep you updated at every stage.

And we don’t stop once the consolidation is complete. We’ll check in regularly to make sure your home loan still meets your needs and help you explore opportunities to pay it down faster.

With Loan Theory, you’re not just getting a debt consolidation loan, you’re getting a partner who’s here to simplify your finances and set you up for long‑term success.

DOWNLOAD THE GUIDE

The Ultimate Debt Consolidation Guide

Sometimes those expenses, those bills get away from us. Whether its the surprise vet bill, the car service, the increase school fees. Whatever it is sometimes it can tip the carefully balanced budget and create some high interest debt we don't want. This guide is the start of getting on top of it.

GET THE DEBT CONSOLIDATION CALCULATOR

Check your potential saving for yourself

Sometimes those expenses, those bills get away from us. Whether its the surprise vet bill, the car service, the increase school fees. Whatever it is sometimes it can tip the carefully balanced budget and create some high interest debt we don't want. This guide is the start of getting on top of it.

The Calculator

The How To Video

TALK TO SOMEONE TODAY BEFORE IT'S TOO LATE

Don't let your debts spiral. Get no judgement help today

COMMON DEBT CONSOLIDATION LOAN QUESTIONS

Here to answer all of your questions

What is your situation? What loan product is right for you? We have over 30 lenders, with over 200 different products. Not everyone is the same, not every loan is the same. Request a call today about your situation.

How does a debt consolidation loan work?

A debt consolidation loan combines multiple debts, such as credit cards, personal loans or car loans, into one loan with a single repayment. By rolling them into your home loan, you can often secure a much lower interest rate compared to unsecured debt. This can make your repayments easier to manage and potentially reduce your overall interest costs.

Can I consolidate my credit cards, personal loans and car loans into my mortgage?

Yes, in many cases you can. Most lenders will allow you to add these debts to your mortgage, provided you have enough equity in your home and can meet their lending criteria. We will review your debts and current home loan to see if consolidation is a good fit for you.

Will consolidating my debts into my home loan save me money?

It can, but it depends on your situation. Home loan interest rates are usually much lower than personal loan or credit card rates, so you could save money on interest. However, if you extend the loan term, you may end up paying more over time. We will run the numbers for you so you can see the true cost and potential savings.

How much can I borrow for debt consolidation?

This depends on your home’s value, the amount you owe on your current mortgage, and your income and expenses. We will assess your borrowing capacity and the equity available in your home to determine how much you can consolidate.

Will I need equity in my home to consolidate debt into my mortgage?

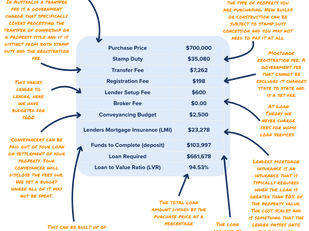

Yes, you generally need equity — the difference between your home’s value and the amount you owe. Most lenders require you to have enough equity to keep your loan under their maximum Loan to Value Ratio (LVR) limits, which is often 80% without Lenders Mortgage Insurance.

Does debt consolidation affect my credit score?

Initially, your credit file will show a new loan application, which may have a small temporary impact on your score. Over time, if you manage your repayments well and close your old accounts, consolidation can actually improve your credit profile by reducing your overall debt and demonstrating positive repayment behaviour.

Will my repayments be lower if I consolidate my debts?

In most cases, yes. Because home loans usually have lower interest rates and longer terms than personal loans or credit cards, your monthly repayment can drop significantly. However, this may also mean it takes longer to repay the debt unless you make extra repayments.

What are the risks of consolidating debt into a home loan?

The main risk is extending short‑term debts over a longer period, which can increase the total interest you pay. There is also the risk of running up new credit card or personal loan balances after consolidating, which can leave you in more debt than before. We will guide you on how to avoid these pitfalls and use consolidation as a step toward becoming debt‑free.

How long will it take to pay off my consolidated debt?

This depends on the term of your home loan and whether you make extra repayments. While you can spread the debt over the life of your mortgage, we recommend setting a shorter repayment plan or making extra repayments so you clear the debt faster and pay less interest.

Are there fees or costs involved in consolidating my debt into a mortgage?

There can be. Some lenders charge application or settlement fees, and there may be discharge fees from your current lender. We will calculate all costs upfront and factor them into your decision so you know exactly what you are committing to.