GUARANTOR LOANS

GUARANTOR LOANS

Educate, Facilitate, Accelerate

At Loan Theory, we make the guarantor loan process simple and easy to understand. If you have a family member who is willing to support your home purchase by offering their property as security, a guarantor loan can help you buy sooner, borrow more or avoid paying Lenders Mortgage Insurance.

We work with over 30 lenders and have access to more than 200 loan products, so we can match you with a guarantor loan that suits your needs and your guarantor’s comfort level. Every lender has different rules about who can be a guarantor, how much security they need to provide and how the guarantee can be released. We guide you through each step so you can make informed decisions.

Guarantor loans can be suitable for:

-

First home buyers – Enter the property market without a large deposit

-

Upgraders – Purchase a bigger home without selling your current one first

-

Those wanting to avoid Lenders Mortgage Insurance – Save thousands in upfront costs

-

Borrowers needing a higher loan amount – Increase your purchasing power

We will explain how guarantor loans work, the responsibilities involved and the potential risks to the guarantor. We also help structure the loan so the guarantee can be released as soon as possible, giving peace of mind to both you and your guarantor.

Our process is straightforward. We start by understanding your goals, your deposit position and your guarantor’s willingness to help. We then present clear loan options so you can choose with confidence. We handle the application from start to finish, liaising with all parties and keeping you informed every step of the way.

Once your loan settles, we will continue to review it regularly. When the time is right, we can arrange to remove the guarantor from your loan and transition you to a standard home loan.

With Loan Theory, you are not just getting a guarantor loan. You are getting a lending partner who will support you, your guarantor and your property goals from start to finish and beyond.

COMMON GUARANTOR LOAN QUESTIONS

Here to answer all of your questions

What is your situation? What loan product is right for you? We have over 40 lenders, with over 200 different products. Not everyone is the same, not every loan is the same. Request a call today about your situation.

What is a guarantor loan and how does it work?

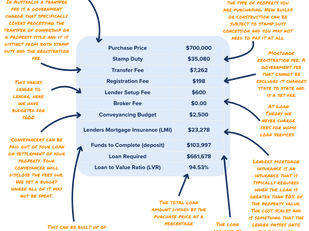

A guarantor loan allows a family member to use the equity in their property to help you secure a home loan. Instead of giving you cash, the guarantor offers a portion of their property as security, which can reduce or even remove the need for a deposit.

Who can be a guarantor for my home loan?

Usually, guarantors are close family members such as parents. Some lenders may also consider siblings or other relatives. The guarantor must meet the lender’s requirements for income, equity, and credit history.

Do guarantors have to be family members?

In most cases, yes. Lenders generally prefer immediate family members because of the high level of trust involved. Very few lenders will accept non‑family guarantors.

How much of the loan does the guarantor have to guarantee?

It depends on the lender and your situation. In many cases, the guarantor only covers the amount needed to bring your loan‑to‑value ratio (LVR) down to 80%. This often means they are guaranteeing a smaller portion of your total loan rather than the full amount.

What are the risks for the guarantor?

If you can’t meet your loan repayments, the lender can ask the guarantor to cover the shortfall. In extreme cases, this could mean the guarantor’s property is at risk. It’s important for guarantors to seek legal and financial advice before committing.

Can using a guarantor help me avoid Lenders Mortgage Insurance (LMI)?

Yes. By lowering your LVR to 80% or less, a guarantor can help you avoid paying LMI, which can save you thousands of dollars upfront.

Does the guarantor need to have their property fully paid off?

Not necessarily. The guarantor simply needs to have enough usable equity in their property to cover the guaranteed amount. However, the property will be used as security for your loan.

Can the guarantor be removed from the loan later?

Yes. Once you’ve built up enough equity in your property (usually when your LVR is 80% or less), the guarantor can be released from the loan. This process usually requires a property valuation and lender approval.

Will being a guarantor affect the guarantor’s ability to borrow in the future?

Yes. Since the guaranteed portion counts as a liability, it may reduce the guarantor’s borrowing capacity for other loans until they are released from the guarantee.

Can a mortgage broker help structure a guarantor loan to protect everyone involved?

Absolutely. We can recommend lenders with flexible guarantor policies, help structure the guarantee so it covers only what’s necessary, and guide both you and your guarantor through the process to minimise risks.