REFINANCE LOANS

REFINANCE LOANS

Educate, Facilitate, Accelerate

At Loan Theory, we make refinancing your home loan simple and worthwhile. Whether you want a lower interest rate, better loan features, to access equity for renovations or investments, or to consolidate debts into your mortgage, we can help you find the right refinance solution.

We work with over 30 lenders and have access to more than 200 loan products, so we can match you with a refinance loan that suits your needs and long term goals. Every lender has different policies, fees and offers for refinancing. We compare them for you so you can make an informed choice and get the best value for your situation.

Refinance loans can be suitable for:

-

Lowering your interest rate – Reduce repayments and save money over time

-

Accessing equity – Fund renovations, investments or other large expenses

-

Switching loan features – Add an offset account, redraw facility or flexible repayment options

-

Consolidating debt – Combine personal loans, car finance or credit cards into your home loan for easier management

We will assess your current home loan, calculate your potential savings and compare offers from multiple lenders. We also guide you through the timing of your refinance to ensure you avoid unnecessary fees or delays.

Our process is straightforward. We start by reviewing your goals, financial position and current loan. We then present clear options in plain language so you can choose with confidence. We handle all the paperwork, liaise with your new and existing lender and keep you informed every step of the way.

Once your refinance is complete, we will continue to review your loan regularly to make sure it remains competitive and suitable for your needs.

With Loan Theory, you are not just refinancing your loan. You are getting a lending partner who will help you save money, improve your loan structure and make sure your mortgage continues to work for you in the years ahead.

COMMON LOAN REFINANCE QUESTIONS

Here to answer all of your questions

What is your situation? What loan product is right for you? We have over 40 lenders, with over 200 different products. Not everyone is the same, not every loan is the same. Request a call today about your situation.

What does refinancing a home loan mean?

Refinancing means replacing your current home loan with a new one, often with a different lender. People refinance to get a lower interest rate, access better features, consolidate debts, or unlock equity for other goals.

How do I know if refinancing will save me money?

We compare your current loan against other options in the market. If the savings on interest and fees outweigh the cost of switching, refinancing is likely worth considering. Even a small drop in your rate can lead to big savings over the life of the loan. If we find there is no benefit for you to refinance we suggest you do not refinance.

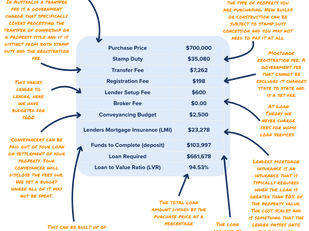

What costs are involved in refinancing?

Costs can include discharge fees from your current lender, new lender setup fees, government registration fees, and possibly Lenders Mortgage Insurance (LMI) if your equity is under 20%. We’ll calculate these upfront so you know exactly what to expect. If the costs outweight the interest rate benefits, we suggest you do not refinance.

Can I refinance if I’m still in a fixed‑rate period?

Yes, but breaking a fixed‑rate loan may trigger break costs. These can be high, so we’ll weigh up the potential savings against the cost before making a recommendation.

Will refinancing affect my credit score?

A single refinance application generally has a small impact on your credit score. However, multiple applications in a short time can have a greater effect. Working with a broker ensures we only apply for loans that you’re likely to be approved for.

Can I use refinancing to consolidate debts?

Yes. You can roll personal loans, credit cards, and other debts into your home loan, which usually has a lower interest rate. This can simplify your repayments and reduce interest costs, but it’s important to manage your spending so debts don’t build up again. See Debt Consolidation

How long does the refinancing process take?

It usually takes two to four weeks from application to settlement, depending on the lender and how quickly documents are provided. We keep you updated every step of the way.

Can I access equity in my home when I refinance?

Yes. If your property value has grown or you’ve paid down your loan, you can access that equity as part of the refinance. Many people use this for renovations, investments, or major purchases.

What documents do I need to refinance?

You’ll need identification, proof of income (payslips or financial statements if self‑employed), details of your current loan, and information about your assets and debts. We’ll give you a clear checklist so nothing gets missed.

Can a mortgage broker get me a better deal than going to my bank directly?

Often, yes. We have access to a wide range of lenders and products, including some offers not advertised to the public. We also negotiate with your existing lender to see if they can match or beat other deals before recommending a switch.